A new data-driven framework helps enterprises model flash pricing risk and design resilient storage architectures amid unprecedented market volatility.

HPC and AI storage supplier VDURA says the price gap between SSDs and hard disk drives is widening as flash prices rise faster than HDD costs.

This should put a stop to the idea that SSDs will kill disk drives, at least until SSD prices drop substantially. VDURA reckons it is a critical market shift that’s particularly acute in AI, HPC, and data-intensive environments where, it says, storage performance requirements remain constant even as media pricing fluctuates. It’s publishing a Flash Volatility Index (FVI) and a Storage Economics Optimizer Tool quarterly to publicize SSD and HDD pricing changes, and help customers investigate tiering possibilities to reduce the impact of sky-high SSD prices.

Erik Salo, VDURA’s SVP of Business Operations, said: “When quotes double or triple in a single quarter, resellers face the uncomfortable task of telling customers their approved budgets are no longer viable. Our goal is to bring transparency to this volatility and help the industry understand what’s driving it, how long it might persist, and alternative options.”

VDURA says that between Q2 2025 and Q1 2026, pricing for 30 TB TLC enterprise SSDs increased 257 percent, rising from $3,062 to $10,950. Over the same period, HDD pricing increased 35 percent, widening the gap between enterprise SSDs and nearline disk drives. Its analysis “shows that the cost multiple between SSD and HDD capacity expanded from 6.2x in Q2 2025 to 16.4x in Q1 2026, significantly increasing the financial risk of architectures that rely exclusively on flash.” It says this SSD-HDD price “divergence has forced enterprises and their reseller partners to confront a difficult reality: storage quotes issued just months ago now require complete budget revisions.”

Its report, The Flash Volatility Index, provides a view of SSD pricing, tracking how flash media supply changes translate into real-world cost exposure and how that compares to the current HDD market. The accompanying Storage Economics Optimizer Tool allows customers “to model total system cost across different storage architectures, performance targets, and media mixes, giving infrastructure teams a way to evaluate trade-offs before committing capital.”

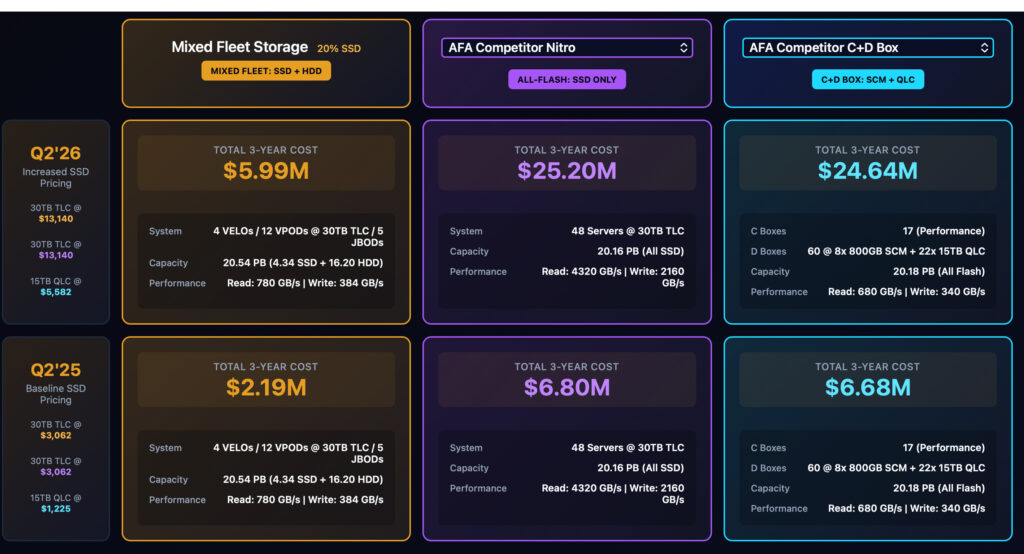

VDURA used its Storage Economics Optimizer Tool to look at the cost impact of flash pricing volatility across common storage architectures for a 25 PB deployment delivering 1,000 GB/s of sustained performance. At Q2 2025 pricing, an all-flash architecture carried an annualized cost of $8.50 million. By Q1 2026, that same configuration increased to $24.54 million, a 189 percent rise driven primarily by flash media pricing.

It says hybrid flash+disk storage architectures, which decouple performance from capacity by combining flash and HDD tiers, experienced significantly lower cost escalation over the same period. Architectural flexibility can reduce exposure to sudden flash market price rises while maintaining required performance levels.

The FVI report illustrates compounding cost pressures across the infrastructure stack. DRAM pricing increased 205 percent over the same Q2 2025 and Q1 2026 period, driven by demand for memory-intensive GPU systems. High-speed networking components face similar constraints, further bulking up total system costs for designs that require higher node counts to meet performance objectives.

According to the FVI report, multi-year hyperscaler purchasing agreements have locked up a significant portion of global SSD manufacturing capacity through 2026. At the same time, large-scale AI infrastructure deployments continue to absorb remaining supply. Industry outlooks suggest pricing pressure may persist into 2027 and beyond.

“After more than a decade of relatively stable NAND pricing, the rules have changed,” said Salo. “Infrastructure leaders need real data to understand what’s happening and plan accordingly. That’s what we’re providing.”

Check out VDURA’s FVI and Storage Economics Optimizer Tool here.